This article discusses part of the Growzania financial independence model focusing on the steps to develop a financial independence plan.

If you are very new to the personal financial independence journey, you can always refer to our articles here to understand some of the important personal finance terminologies.

What is financial independence?

In the simplest of ways, financial independence is having enough money to cover your living expenses available for the rest of your life, whether you are employed or earning any income or not.

To expound a bit on what financial independence is, think about it as having a big pot of cash that you can dip into endlessly to pay for your basic living expenses. The keyword here is “basic” in that you can always pay for your food, house, clothes, and other necessities.

This pot would be available to you without requiring you to earn money through gainful employment or rely on friends or relatives.

One crucial element of financial independence is that once you achieve it, it does not mean that you will no longer need to work. It simply means that you will have the freedom and choice of what to do with your time.

You can always choose whether to work or not. You can always decide which days to work, what type of work you take vs. what you leave. You can always follow your dream by spending your time on your passion.

That freedom is what financial independence is all about. To summarize, financial independence is the ability to choose what to do with your time without worrying about paying for your day-to-day expenses.

Financial independence varies from person to person

Financial freedom depends a lot on the individual.

For example, if at an early age of 25 years, you only have expenses worth $200, and you have a fund with $3000 saved earning you 8% interest annually, you will have achieved financial independence.

However, as you grow older, so do your responsibilities and needs change. The 25-year-old in this example, may be living with their parents, thus not have any responsibilities towards housing or rent.

For an older person, they may need upwards of $100,000 to $1,000,000 in savings because their living expenses would be much higher since they have to pay for their house, food, children’s education, car expenses, utility bills, and much more.

The first and possibly most important thing about financial independence is to know what your financial independence number is. We are developing a simple calculator to help you with this.

Why should you work towards financial independence?

All reasons you should work towards your own financial independence can be summarized as having the freedom to choose what to do without worrying about your expenses.

Here are some of the reasons why to work towards financial independence:

- Job security is more complicated in today’s world

Many people still rely on gainful employment as their primary source of income. However, in today’s Volatile, Uncertain, Complex & Ambiguous (VUCA) world, job security is a mirage. We cannot trust that we will have our jobs forever.

- You will stop living in the rat race

When you are financially independent, you will not be yearning to grow within your organization to earn more money. You will no longer be a slave to the rat race.

- You can increase your ability to help others

Being financially independent allows you to spend your time helping others. You can also spend your money helping others too. When you no longer worry about your daily expenses, you will have more time to do good in the world.

- It allows you to follow your passion

When you are financially independent, you can choose what kind of work you do. You will be able to explore your skills and abilities and follow your passions. You will be able to decide how best to drive action towards achieving your personal goals and dreams.

Introduction to the six (6) steps to financial independence

There are many ways to achieve financial freedom. Each of these strategies has its benefits and challenges.

No matter which system or strategy you choose, you will always find that you need to apply some steps to achieve financial independence.

We developed the Growzania model for financial independence for this reason. We based our model on six (6) steps and with three (3) key enablers towards financial freedom.

Why Growzania Model has six (6) steps to financial independence, unlike the Seven (7) baby steps by Dave Ramsey

Dave Ramsey’s seven (7) baby steps (www.daveramsey.com/new/baby-steps/) is a great model for financial independence. Thankfully, our Growzania model is pretty similar.

Two (2) basic elements will help you achieve financial independence. The first is accumulating assets and the second is reducing your expenses. Our model and Dave Ramsey’s seven (7) baby steps model are pretty similar in that way. They both focus on delivering financial independence through these two (2) big blocks – accumulating assets and reducing your expenses.

So without further ado, let’s dive into the Growzania model with six (6) steps towards financial independence.

Step 1 – Build an emergency fund with at least $1,000 in savings

No matter which country you live in, work towards having an emergency fund with more than $1,000 or the equivalent in your currency.

Time and time again, I constantly repeat that less than 4 in 10 Americans can pay a surprise bill of $1,000 if it came today. Therefore, you will be better than these people once you have your emergency fund.

An emergency fund is your pot of money available for unexpected life events that you cannot plan. Examples are tire bursts, surprise medical bills outside your medical insurance, or emergency repairs you need to do on your home or car.

Do not let these emergencies hurt your savings account. That is why you always need to have a separate emergency fund.

We love questions, please ask one

Here at Growzania, we love investing in people, and we are here to help you on your personal growth adventure. Please feel free to reach out to us if you have any questions.

A bonus tip on your emergency fund – keep it replenished at all times

We often get a good question on how to fill your emergency fund after you have spent some of the money. The best way to deal with this is to divide the amount you have used into a period of, say three (3) to six (6) months.

For example, if you spend $200 to repair your car, you should aim to save back $66 over three (3) months or $33 over six (6) months back into your emergency fund to keep it above $1,000 at all times.

A second bonus tip on your emergency fund – let it grow by earning interest

Save your emergency fund money in an interest-growing account. However, choose one that you can easily unlock within 1 – 3 days when the emergency hits. A good example is to save in a money market fund where you can always withdraw the cash within three (3) days. The interest that your emergency fund earns will help you in case of future emergencies.

Step 2 – Pay off your debt with the avalanche method

Once you have built your emergency fund, the next thing to do is evaluate your debt and start applying the avalanche method to clear the debt.

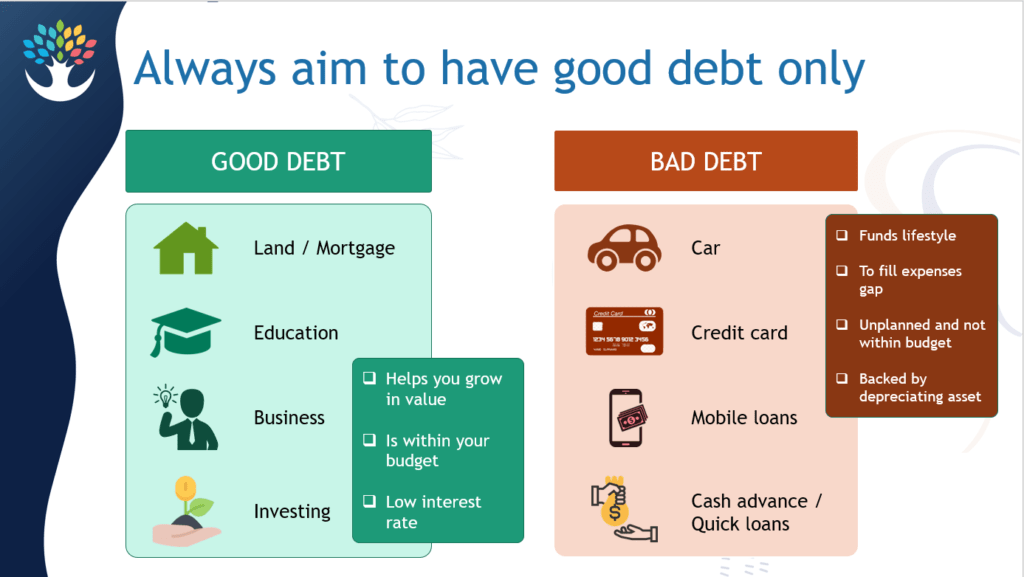

Before we discuss clearing your debt, please remember that we at Growzania always advise you only to have good debt and get rid of bad debt. Below we have a simple reminder of the difference between good and bad debt.

Take a list of all your debts – car loans, credit card loans, student loans, and any other loans that you have. Here, let us exclude your mortgage because this is a long-term debt that required a different strategy to clear.

Once we have figured out all the loans, we need to put them in order based on the interest rate, from the largest to the smallest. Always pay minimum payments for the loans with the lowest interest rate. If you have any surplus in your budget, put it towards extra principal repayments for the highest interest rate loan.

Once you have cleared the highest interest rate loan, take the minimum payment you were making on this loan together with the surplus and apply it towards the next loan with the highest interest rate.

The avalanche method for clearing your debt will help you do this.

Why should I use the avalanche method rather than the snowball method?

This step is where our Growzania model differs significantly from the Dave Ramsey 7 Baby Steps model. Dave Ramsey’s model advocates for using the snowball method. Here, you pay off the loan with the lowest balance first regardless of interest rate, while our method advocates for paying the loan with the highest interest rate first.

We believe the avalanche method is best because it helps you take into account the time value of money and your interest exposure. When a loan has a higher interest rate, you have a high interest that is payable, and interest is an expense.

For this reason, we advocate for you to reduce your interest expense by paying off the loan with the highest interest rate. Of course, except if the loan with the highest interest rate is tiny and will not impact your other loans’ repayment even if you clear it first.

Step 3 – Save up enough money to cover at least 3 – 6 months’ worth of your expenses

At this point, you have paid off your debts, and you now have a bit of surplus in your budget since you have reduced your expenditure on repaying your loans. At this point, we advise you to put this money towards building a separate fund with at least 3 to 6 months of your expenses.

Earlier in this article, we spoke about job security being a mirage. Similarly, if you are in business, no two months are ever alike. Your business has some seasonality, and you cannot expect your income to be the same every time.

That is why you should have this extra fund. It will protect you from these extra surprises that life might throw at you without requiring you to take on debt to pay for your monthly expenses.

Step 4 – Budget to save & invest at least 20% of your earnings

Now that we are more secure with our finances being debt-free, and having some good savings for your monthly expenses, now it is time to lift the heavyweights. This is where the rubber meets the road.

To accumulate assets, it is crucial to save a good chunk of your earnings and watch it grow. Remember, we always say that investing is like watching paint dry or watching grass grow. It should never be fun and should never happen fast. It is the consistency of investing and savings that will benefit you. So, don’t trade off the riskier forms of investment for faster returns.

A fool and his money are soon parted.

Thomas Tusser

So work towards investing at least 20% of your monthly income in a plan that earns you investment. If your country has an excellent retirement scheme, e.g., a 401(k) or Roth IRAs, you can put the money there. Alternatively, you can leverage other safe investments through money market funds, balanced funds, stocks, and much more.

Step 5 – Pay off your home mortgage

At this point, you should feel your load become lighter, and now that you have done this for quite a while, it should feel like it is clockwork, and you are putting in minimal effort towards your financial independence.

If you have a mortgage or a home loan, this is the time to clear it. Remember earlier, we only cleared all debts, except your mortgage. So, at this point, we are now working towards clearing your mortgage.

Go back to your budget, and check your surplus. If you do not have any surplus because you have stretched yourself out a lot by saving 20% and in the other earlier steps, review your budget and ask yourself some what-if questions. What can you cut to create a surplus?

Use this surplus to reduce the principal on your mortgage. You will save a lot in interest payable on your mortgage.

Step 6 – Build wealth through passive income and investing

One of the most significant elements that will help you achieve financial independence is moving from relying on the active income to building your passive income.

Active income requires you to spend your time to gain income, while passive income is earning money while you sleep.

Some of the sources of passive income are:

- Fixed deposits held in banks

- Monthly income schemes

- Pooled funds – for example, money market funds, balanced funds

- Dividends from stocks, income trusts, and bonds

- The interest you earn from loans or deposit accounts

- Annuities that payout to you

- Pension payouts

- Rental income from houses/units that you own

- Royalty from creative work, e.g., music, photography, books, and more.

Drop Shipping, Blogging, Online Video, Affiliate Marketing, Information Products

In today’s digital world, there are also many passive income sources that you can leverage by using active time to build an item that sells itself or earns you money. You put in the time upfront to create the item then it earns income in the future. Examples of these are:

- Creating an online course

- Making YouTube videos

- Blogging

- Instagram Sponsored Posts

- Creating an app

- Being a host in Airbnb

- Affiliate marketing

Oberlo has a great guide on these digital sources of passive income available here – https://www.oberlo.com/blog/passive-income

In this step, we are trying to create a steady flow of income that does not need you to put in a lot of time. Making money while you sleep.

Bonus Step 7 – Give back to the community

Based on the six (6) steps above, we firmly believe that you will have achieved financial independence. So, why not help other less fortunate people in the world? Why not create a legacy by solving some of the world’s problems like access to food and healthcare for orphans, universal health care, or educating the less fortunate?

It is one of the reasons why Bill Gates now gives back a lot through the Bill & Melinda Gates Foundation.

Final thoughts on the steps to financial independence

Achieving financial independence is a long-term journey that requires you to embrace the two key elements – accumulating assets and reducing your expenses. We have outlined the six (6) steps you can follow based on our model.

Please share your thoughts and comments on this topic to help others who may have similar questions in their minds as well.